Social Security in the United States is facing several challenges that necessitate changes to ensure its sustainability and adequacy. Chief among these are long-term solvency issues due to an aging population and a declining worker-to-retiree ratio. Funds are projected to become insolvent in 2033 or 2034, according to the latest estimate.

See: 4 Social Security Shakeups from Biden That Could Hit Your Wallet by 2024

Find: 3 Ways To Recession-Proof Your Retirement

Although the majority of retirees’ benefits will still be covered by taxpayers, the government and the Social Security Administration (SSA) are going to have to make some tough choices regarding the program in the very near future. Taxpayers are going to have to brace for cuts to the program at some point.

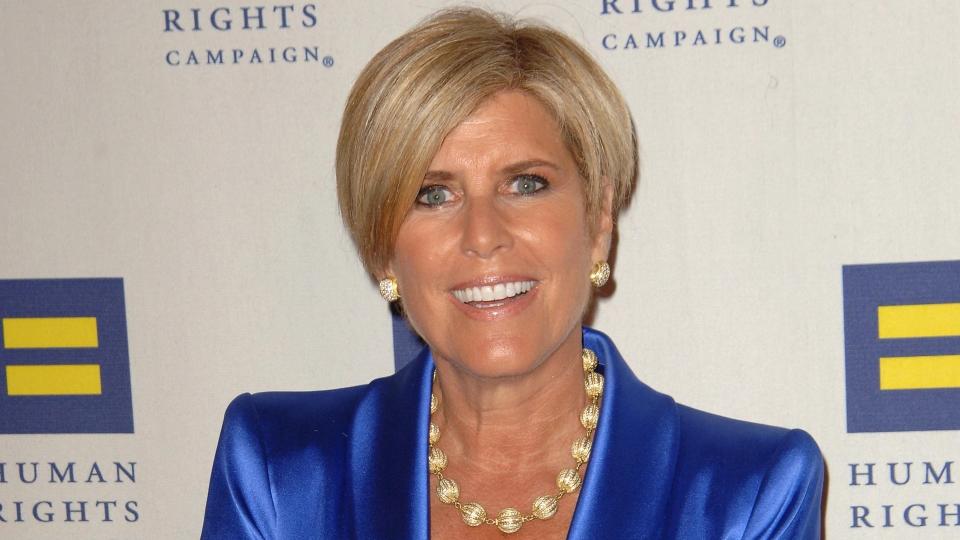

Adjustments to a few related issues, like benefit formulas, cost-of-living adjustments (COLA), means testing for high-income earners and changes to wage caps have been hotly debated by lawmakers and experts for years now, including personal financial advisor and bestselling author and podcaster Suze Orman.

“Social Security’s in trouble; we are in trouble. And the only people that are going to save us, is us,” Orman told Moneywise last year. Here are three pressing issues that Orman and others are predicting will have to be addressed at the earliest possible time.

Raising the Full Retirement Age to 70

Orman has frequently gone on record as being a “big…