Is it time to move out of the US stock market? In the past decade it has served investors very well, including many UK retail savers who have steadily switched funds out of the dejected London market for America.

But stock valuations are high, with a lot hanging on the performance of a handful of mega tech companies that have generated all the recent gains in the S&P 500 index.

Moreover, the US is already gearing up for next year’s presidential election — a huge political battle that seems certain to inflame public debate, and spread uncertainty, division and even fear. Hardly the best conditions for calm business decision-making.

Trading volume in options linked to the Vix volatility index — widely seen as Wall Street’s “fear gauge” — is set to reach a record this year, as equity investors seek to protect themselves from the risk of a sudden reversal, as the FT reported this week.

This year investors have traded an average of 742,000 options tied to the Vix each day, according to exchange operator Cboe, up more than 40 per cent on the same period in 2022 and above 2017’s full-year record of 723,000.

While the US is well known for its economic and financial resilience, could this be the time for investors to look elsewhere? Or should they keep betting on America and its world-beating tech sector? FT Money looks at the arguments.

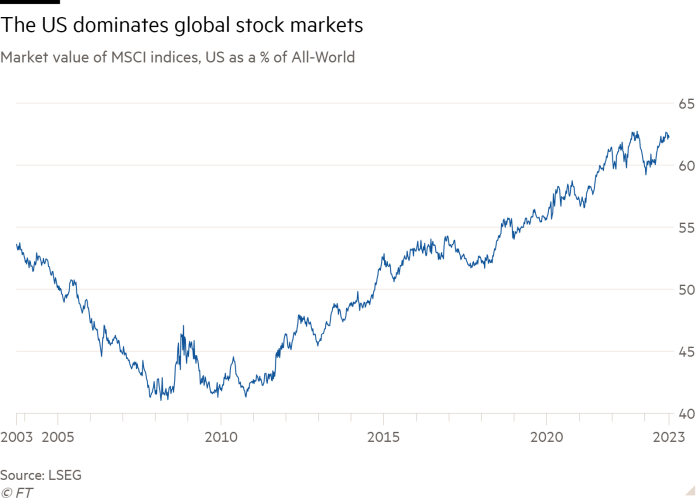

Too big to ignore

No equity investor can ignore the US stock market: it’s the 800-pound gorilla of shares. It is not just that…