Recap for February 5

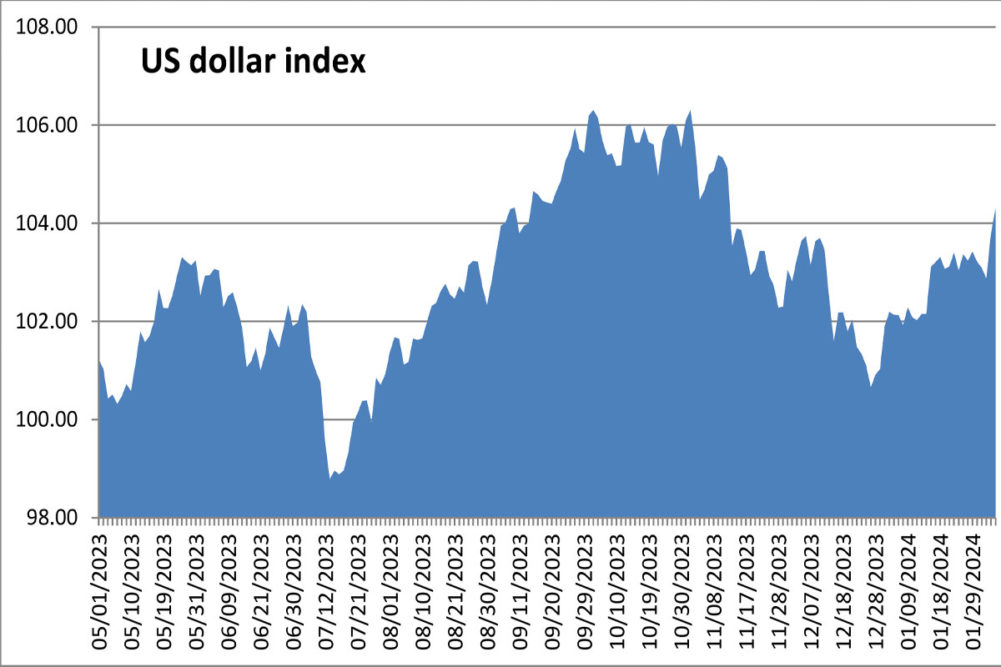

- The US dollar index climbed again on Monday as investors continued to digest Friday’s Department of Labor reports showing US employers added more than double the expected jobs in January and that the unemployment rate held steady at 3.7% last month, bucking expectations of an increase.

- US wheat futures were under pressure to open the week from a stronger US dollar and last week’s declines in Russian wheat prices. Soybean futures overcame the dollar’s pressure and climbed as traders began to adjust positions ahead of fresh supply-demand data coming Thursday from the US Department of Agriculture. Corn futures traded choppily and closed mixed ahead of Thursday’s USDA report. The March corn future was steady at $4.42¾ per bu with later months mixed in a narrow range. Chicago March wheat dropped 9½¢, closing at $5.90¼ per bu. Kansas City March wheat shed 11¢ to close at $6.14 per bu. Minneapolis March wheat dropped 8¾¢ to close at $6.91 per bu. March soybeans ascended 7¾¢ to close at $11.96¼ per bu. March soybean meal added $4.30 to close at $361.10 per ton. March soybean oil rose 0.6¢ to close at 45.33¢ a lb.

- US equity markets fell back Monday after Sunday night’s “60 Minutes” interview in which Federal Reserve chairman Jerome Powell said, “We feel like we can approach the question of when to begin to reduce interest rates carefully,” and…