Kura Sushi USA, Inc. (NASDAQ:KRUS) shares have continued their recent momentum with a 31% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

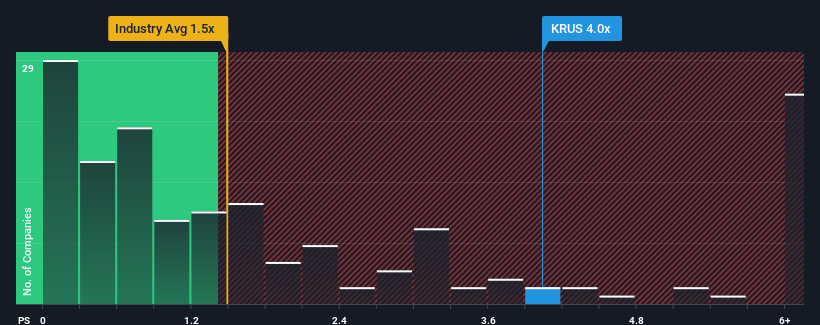

Following the firm bounce in price, you could be forgiven for thinking Kura Sushi USA is a stock to steer clear of with a price-to-sales ratios (or “P/S”) of 4x, considering almost half the companies in the United States’ Hospitality industry have P/S ratios below 1.5x. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kura Sushi USA

How Kura Sushi USA Has Been Performing

Kura Sushi USA certainly has been doing a good job lately as it’s been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Kura Sushi USA will help you uncover what’s on the horizon.

Do Revenue Forecasts Match The High P/S Ratio?

The only time you’d be truly comfortable seeing a P/S as steep as Kura Sushi USA’s is when the company’s growth is on track to outshine the industry decidedly.

Taking a look back first, we see that…