-Oxford-

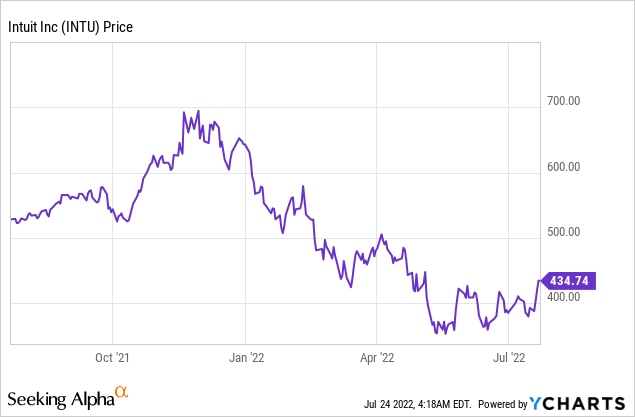

Intuit (NASDAQ:INTU) is a leading financial software provider, which focuses on helping small businesses. The company was founded in 1983 in Mountain View, California and rode the wave in digital accounting. By the 1990s, the company had 1.3 million customers and today they have over 100 million customers. Intuit’s share price went on a tremendous bull in 2020 and increased by over 200% from the March lows till the December highs. The high inflation numbers released in the fourth quarter of 2021 and the subsequent interest hikes, acted as one catalyst for the stock price to plummet by ~47%.Since then the stock has made gains of ~20% (since my last post), but is still down substantially from its highs. Intuit stock is still undervalued intrinsically and relative to historic multiples, despite the gap between price and value closing slightly. Thus, let’s dive into the Business Model, Financials and Valuation for the juicy details.

SaaS Business Model

Intuit offers a suite of financial software products which include: QuickBooks, TurboTax, Credit Karma, Mint and now Mailchimp which was recently acquired. Managements mission is to help solve its small business customer problems, which include everything from “Getting Customers” to tracking accounting and filing tax returns.

Intuit Software Products (Official Website)

QuickBooks is Intuits flagship digital accounting product. This is the market leading Digital Accounting Software in the US and…