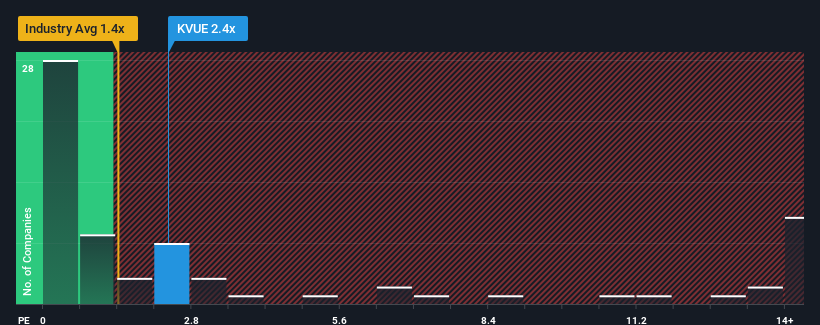

When close to half the companies in the Personal Products industry in the United States have price-to-sales ratios (or “P/S”) below 1.4x, you may consider Kenvue Inc. (NYSE:KVUE) as a stock to potentially avoid with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it’s justified.

Check out our latest analysis for Kenvue

How Has Kenvue Performed Recently?

There hasn’t been much to differentiate Kenvue’s and the industry’s revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Kenvue’s future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Revenue Growth Forecasted For Kenvue?

The only time you’d be truly comfortable seeing a P/S as high as Kenvue’s is when the company’s growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.2%. The solid recent performance means it was also able to grow revenue by 7.5% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 3.0% each…