Despite the COVID-19 pandemic leading to massive unemployment in the United States during 2020, Americans paid off a record $82.9 billion in credit card debt, according to the latest Credit Card Debt Study by the personal-finance website WalletHub.

Analysts of the Credit Card Debt Study said the reduction is a major accomplishment considering consumers have added an average of $54.2 billion in credit card debt per year over the past 10 years.

“The latest credit card debt statistics tell us that American consumers are actually getting healthier financially in some respects because of the coronavirus pandemic,” said Jill Gonzalez, WalletHub analyst, in a news release. “We paid off a record $82.9 billion in credit card debt during 2020 – just the second time in the past 35 years we’ve even ended the year owing less credit card debt than we started with.

“Paying off so much credit card debt indicates that consumers have been making the most of the pandemic, by using the stimulus money and COVID restrictions to make their finances more sustainable.”

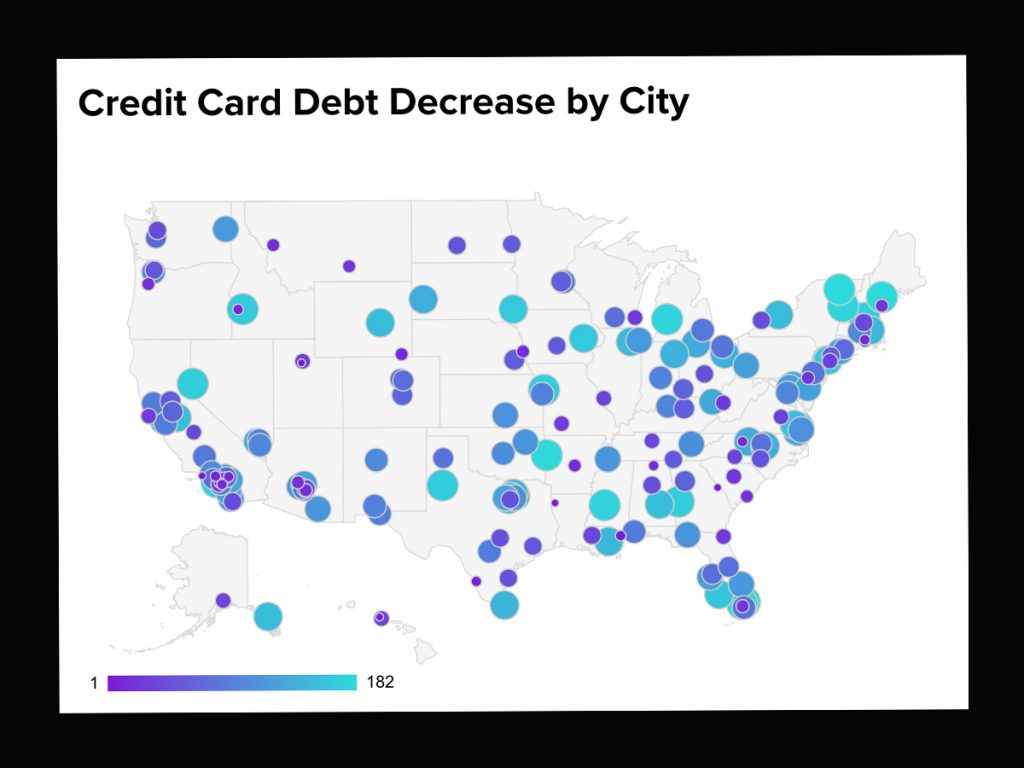

Pearl City on Oʻahu was ranked fourth in the nation for cities with the biggest debt paydown by its households, with an average decrease of $1,147, according to a recent study.

But Pearl City, an unincorporated community in Honolulu County,…