For those last-minute tax filers who were rushing to get their returns done, there’s good news: you’ve been given a one-month reprieve.

Tax Day 2021 has been pushed back to May 17 from April 15 without penalties and interest, giving Americans more time to file their returns as the IRS implements sweeping tax code changes from the latest COVID-19 relief package.

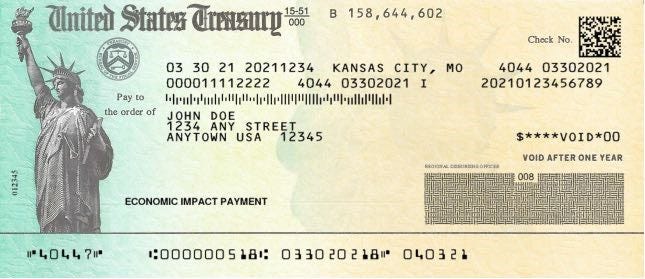

It’s a busy time. Many Americans have tons of questions about their stimulus checks, taxes and unemployment aid after the American Rescue Plan became law. So far, more than 156 million payments have been sent to Americans in the third round.

Save better, spend better:Money tips and advice delivered right to your inbox. Sign up here

Unemployment tax break:IRS tax refunds to start in May for $10,200 tax break

The IRS is sending stimulus checks on a weekly basis now. Some Americans are eligible for “plus-up” payments from the agency, which will correct any changes to money that they are owed based on their 2020 tax returns.

Many people are rushing to get their returns done so they can qualify for the latest stimulus aid, and they have questions like: Is it best to file now? Can I still file my return to qualify for a third stimulus check? When will I get a “plus-up” payment?

Taxpayers are also grappling with questions on everything from unemployment waivers to child tax credits. And others want to know when they need to pay their state taxes, or if they face refund delays.

Here’s what you need to know: