imamember/iStock via Getty Images

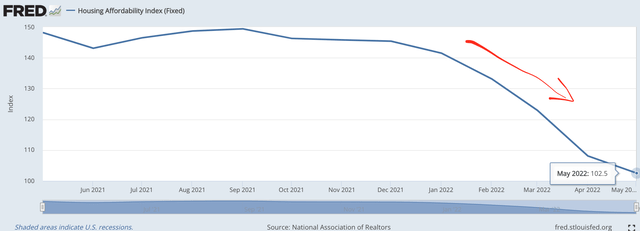

We recently experienced the highest inflation rate since 1981 and thus the Fed is forecasted to slam on the breaks by raising interest rates. Higher interest rates increase mortgage payments and thus affect the affordability of houses to buy. We can see from the chart below the affordability of houses has fell off a cliff since the first quarter of 2022.

House Affordability Index (Fred Economics)

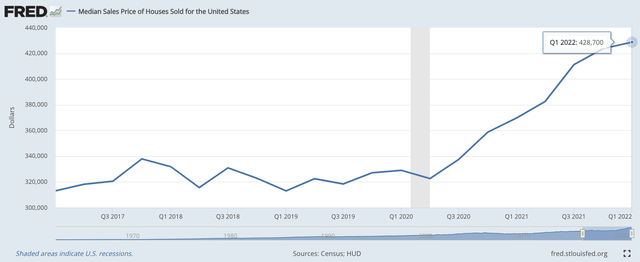

This affordability index is also been driven by rising housing prices, which have been rising faster than the average household income. The Median Sale price for houses sold in the US was a staggering $428,700 in the first quarter of 2022, this is a substantial 33% uptick from the levels seen in Q2 of 2020.

US House Prices (Fred Economics)

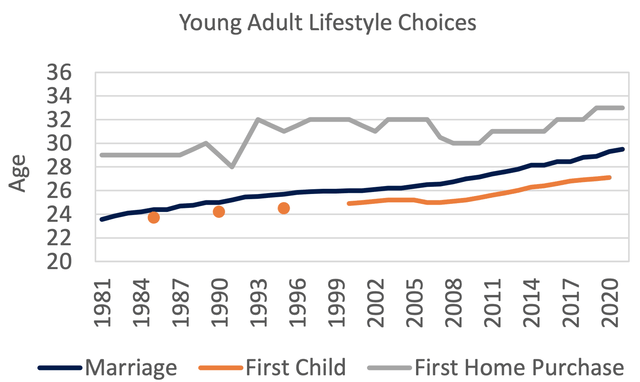

The lack of affordability in housing and many lifestyle changes has caused a drop off in house sales and a surge in those renting. According to a recent study, over one third (35%) of US households rent their homes, with 43 million homes rented. One third of these tenants (34.5%) are under the age of 35, these have been called “Generation Rent”. This younger demographic is getting married, having children, and buying houses much later than prior generations, as you can see from the chart below.

Lifestyle choices (Written Advisors)

Thus it’s no surprise the US has a record number of single people with 4 out of 10 adults between 25 and 54 not married or living with a partner, up by 30% since 1990. These single…